April 16, 2025

Mayor Michelle Wu addressed members of the Boston City Council and staff during a Budget Breakfast held on April 9. Mayor’s Office Photo by John Wilcox

If every “Happy Budget Day” is alike, the City of Boston’s event for FY26 was unhappy in its own way. After four years of steepening budget increases enabled by surge in development set in motion before the Covid-19 pandemic, the fiscal trend line was turning sharply the other way, with local factors more ominously clouded by changes in federal spending and policies.

“In every sector in this moment, I’ve been checking the headlines. I’ve been monitoring the financial markets, and it’s not pretty,” Mayor Wu signaled last week as she opened the budget presentation with leaders of the Boston City Council. “And it looks like to be getting even worse,” she added. “Our families and our communities are already under intense stress with costs of living and other difficulties. And the actions currently that we’re seeing in federal policy are making it even worse.”

As outlined with the City Council’s president, Ruthzee Louijeune and Ways and Means chair Brian Worrell, the FY26 budget calls for a smaller spending increase, while affirming a mission of equity in the face of headwinds from real estate markets and federal policies. Though the mayor and the city’s chief financial officer, Ashley Groffenberger, stressed that city finances, heavily anchored by property taxes and buoyed by AAA bond ratings, were stable, many homeowners have already felt a tidal shift in the fiscal burden—from a more financially vulnerable commercial class to a more unaffordable residential class.

“We need to be prepared, as every city is buckling down for the potential of serious financial crisis triggered by federal economic policy under this federal administration,” Wu said. “The only daily constant is chaos and disruption. And that means it falls to us at the city level to do our very best to partner, to collaborate, to hold strong, and to make sure that we can be a source of stability and opportunity still for our residents.”

The operating budget filed with the City Council totals $4.8 billion, an increase of 4.4 percent over the FY25 budget, which had exceeded the previous year’s total by 8 percent. Officials said this year’s increase was in line with the rate of inflation, which the Boston Municipal Research Bureau, in its social media post the same day, hailed as “a positive development for the city’s long-term fiscal well-being.” The Bureau also noted that much of the FY26 increase was for higher spending on debt service and employee pensions.

Also smaller than its predecessor was the increase in the new five-year capital spending plan, totaling $4.5 billion. Still unspecified in the FY26 operating budget was the amount to cover the new contract for the Boston Teachers Union (BTU). Officials say they expect a vote on the budget in June, after a series of public hearings.

In the operating budget, spending growth for city departments would be 1.7 percent, with no new headcount and the equivalent of 500 vacant positions being eliminated. The need for “buckling down” had already been highlighted in the letter to the mayor from Worrell on March 31, following weeks of budget groundwork.

“Our city remains on solid financial footing,” Worrell wrote, “but in light of the uncertainty around the current federal funding environment, the city should limit its growth beyond collectively bargained raises and increases in health insurance and debt payments. The city can achieve this without cutting critical services, while also including new community-driven investments in eight key areas.”

At the April 9 presentation, Louijeune maintained that the budget had to be “grounded in equity,” explaining, “This means investing in affordable housing, uplifting our immigrant communities, expanding youth jobs and senior programs, empowering our students to become future leaders, and treating community safety as both a public health and public trust issue.”

As shown at the presentation, the budget includes money for anti-displacement efforts, an update of the city’s zoning and the 311 constituent service response system, downpayment help for homebuyers, supportive housing, and legal assistance for renters.

The operating budget calls for a 6.6 percent increase in funding for the Streets Cabinet. That includes funding for improved trash collection—which officials say will help contain the city’s rodent problems. Also being funded are reforms and improvements for the Election Department, which is currently under state receivership, and two replacement classes of recruits in 2026 for the Boston Police Department.

A 2.9 percent spending increase for the Boston Public Schools (BPS) includes money for initiatives prompted by an agreement with the state. Since FY23, city spending on the BPS has increased by 14.7 percent. During that time, the schools have also seen a rise in enrollment of immigrant students.

The capital spending plan has money for redeveloping public housing in Charlestown, South Boston, and Jamaica Plain. Also in the plan are $40 million for a new community center near Grove Hall and $12 million for construction of the new Fields Corner Branch Library. The largest outlay was for the $100 million White Stadium renovation, with additional money for other improvements at Franklin Park. In a post on X, mayoral challenger Josh Kraft criticized Wu for prioritizing the stadium, arguing that money could have been used for other BPS facilities.

The totals for the four operating budgets drawn up by Wu, for fiscal years 2023-26, increased by a combined figure of almost $1.09 billion, compared with an increase of $1.16 billion over eight budget cycles under her predecessors, Marty Walsh and Kim Janey.

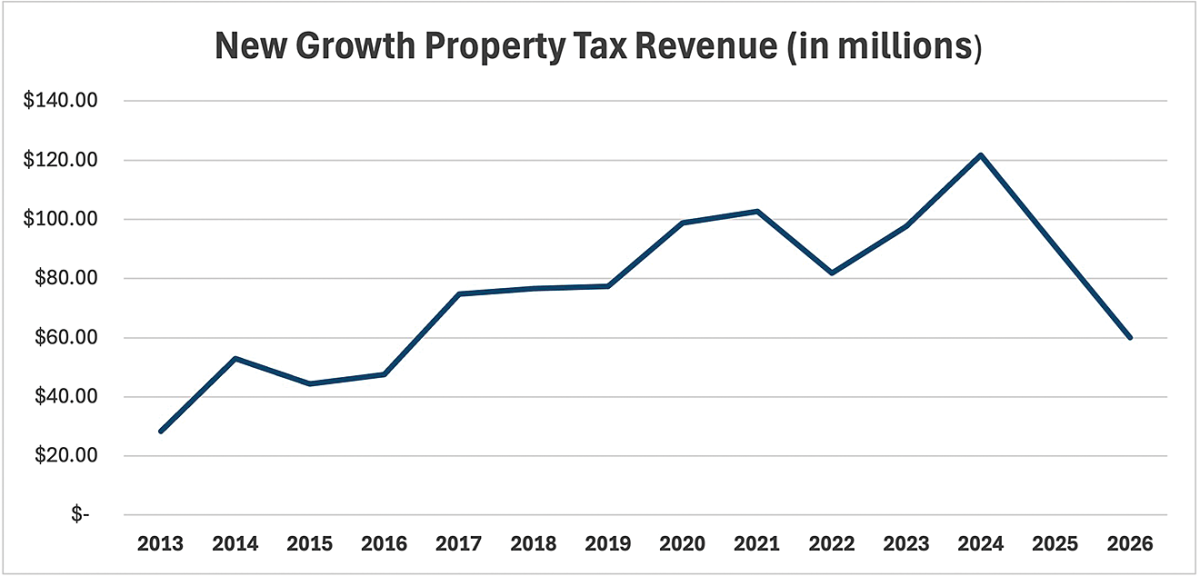

Since 2014, the largest budget increases took place in fiscal years 2023-25. City figures for those years show large upswings in tax revenue from new growth, which surpassed the normal levy increases allowed by Proposition 2 ½ every year from FY2016 through FY2025. After peaking at $121.8 million in FY24, the new growth figure in FY25 was $90.5 million, with $60 million—a formulaic place-marker figure—projected for FY26.

Though Boston’s housing market remains tight, other indicators point to a fall-off in new residential development, partly due to higher interest rates and construction costs, compounded by new uncertainties about the effect of tariffs.

Another concern is the commercial property tax base. Its declining value has shifted more of the tax burden to homeowners. In its survey of Downtown Boston office property for the first quarter of 2025, the real estate services and investment firm CBRE reported five quarters of increasing demand for space. One setback for the area was the planned relocation – and downsizing – of Fidelity’s Boston headquarters from a building on Summer Street to the Seaport District. Yet another setback was the foreclosure sale of the former State Street Financial Center tower at One Lincoln Street. Acquired in 2006 for $900,000, it sold last month for $400 million.

At the budget presentation, Wu raised concerns about the effect of Trump Administration policies on the city’s tourist economy—which could affect local jobs and city revenue from hotels and restaurants. She also registered uncertainty about $300 million in federal money – “a very significant chunk of funding” – that Boston would normally receive for programs in housing, homelessness, public safety, and community development.

“Should we be entering into more serious economic crisis triggered by this federal administration, it may very well get to the point where we will need to be considering layoffs and hiring freezes,” she warned. “I am, and this team are, going to manage as hard as we possibly can to avoid that, because we know that would be not only devastating for the families and workforce of the city, but also the residents who rely on services that are provided.”

Even before the change of administration in Washington, the life science sector in Greater Boston was undergoing a sharp downturn, made worse by an oversupply of lab and office space. By the end of 2024, plans for new lab space were being reconsidered, including those for the large multi-phase redevelopment along Morrissey Boulevard near JFK/UMass Station.

By the time Wu was prefacing the budget presentation, she was also factoring in the effect of federal funding cuts on life sciences—and other parts of the Boston area’s “knowledge economy,” a prime source of growth since the end of WWII.

“We’ve seen that our core industries here in Boston – life sciences, higher education, healthcare research – are all being targeted and threatened with the risk of losing billions of dollars in funding, which for us translates into jobs for our residents and employment being threatened,” the mayor said. “That really threatens people’s ability to put food on the table, not even to mention the critical importance of the research to saving lives and creating opportunity for generations to come.”